The annual EPF contribution by employer and employee sums up to RM 7841 billion as of Q4 2020. As per year 2020 Malaysia EPF funding had reached RM998 billion making it the 4 th largest pension fund in Asia and 7 th largest in the world with the participation of over 7000000 employees and 500000 employers contribution.

St Partners Plt Chartered Accountants Malaysia Epf Monthly Contribution Rate For 2021 Is Available To Download The Third Schedule Please Click At Below Link Https Www Kwsp Gov My Documents 20126 927226 Bi Jadual Ketiga 2020 Kwsp Pdf

EPF has their vision which is helping all Malaysias employees achieve a better future during retirement period.

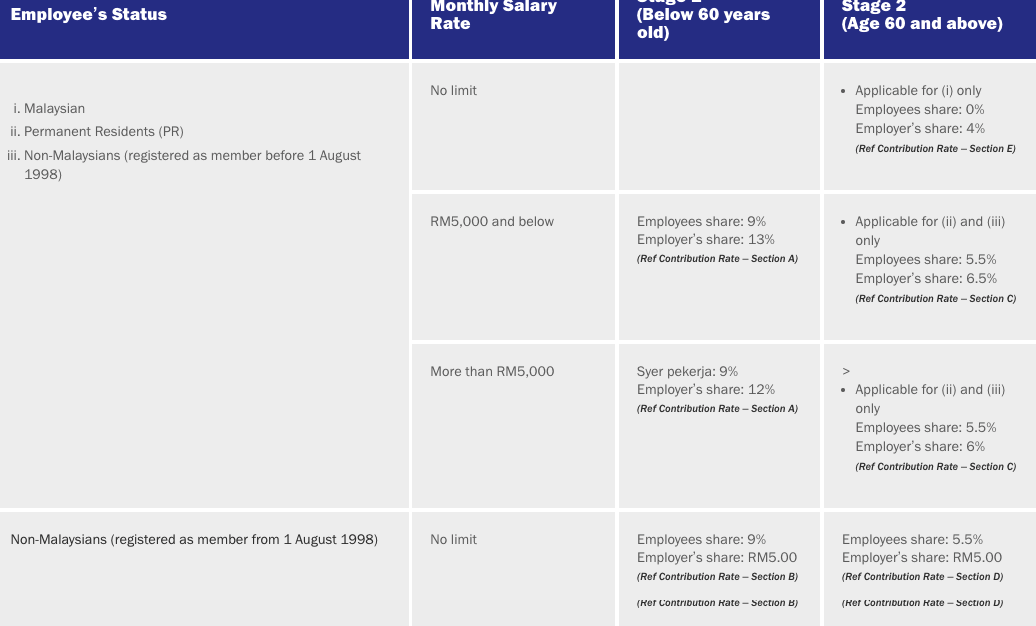

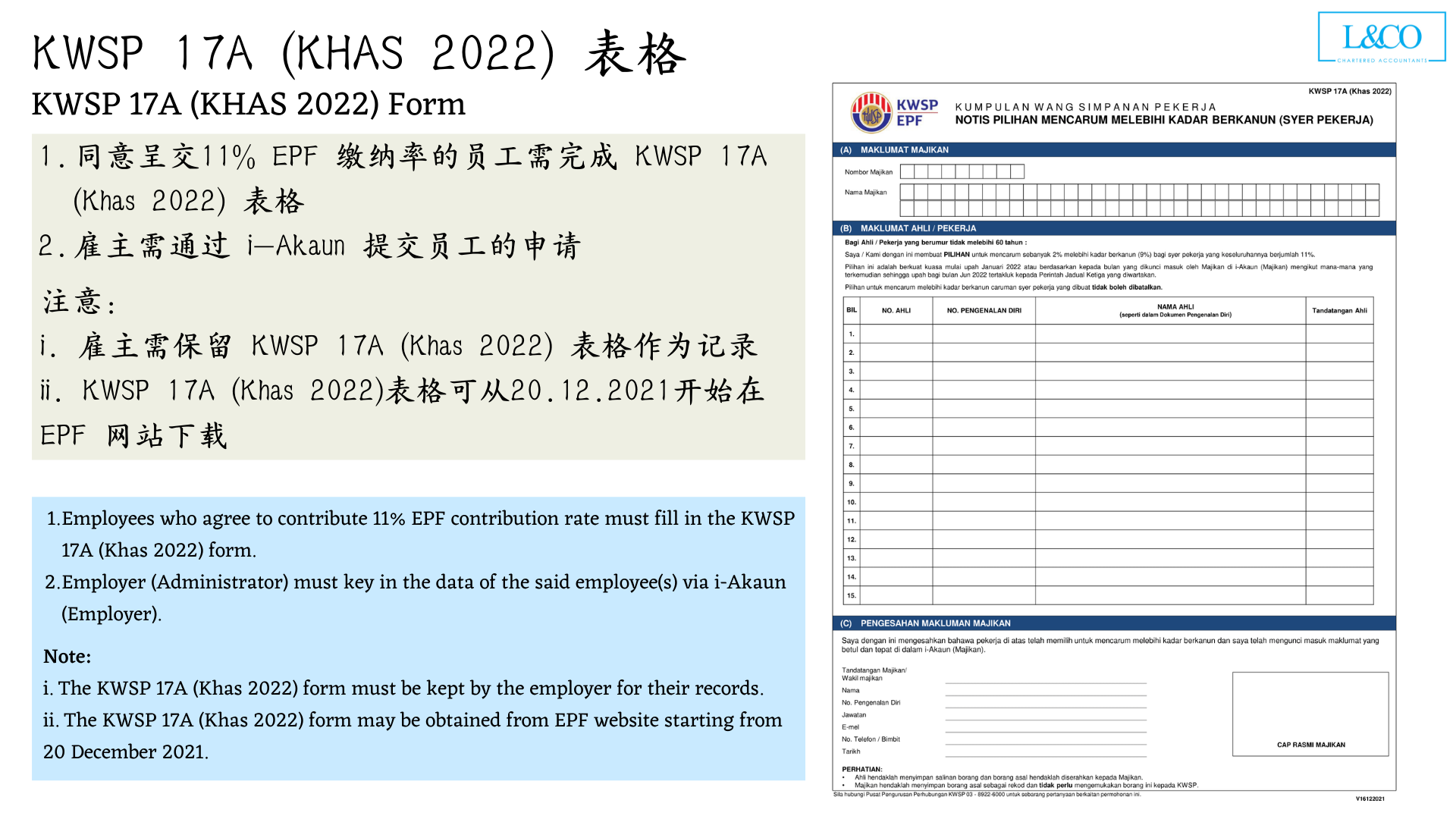

. 1 Employees who wish to maintain their employees share contribution rate at 11 or 55 for employees above age 60 must complete and sign the Form KWSP 17A Khas2016 and submit it to their respective employers. Monthly salary greater than RM5000. Employee contributes 9 of their monthly salary.

12 contribution of monthly salary above RM5000 2. Employees aged 60 and above. Employer 13 contribution of the monthly wages of RM 5000 and below.

The Employees Provident Fund EPF or commonly known as Kumpulan Wang Simpanan Pekerja KWSP is a social security institution formed according to the Laws of Malaysia Employees Provident Fund Act 1991 Act 452 which manages the compulsory savings plan and retirement planning for private sector workers in Malaysia. This savings is comprised of the members and employers shares of the contributions plus the yearly dividends. The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector.

I-Akaun Activation First Time Login. 5 hours agoThe money must go directly to EPF to boost savings and over 10 years the savings can increase by more than RM50000 if contributions from. At least 534398 employers in Malaysia have contributed to EPF.

What is the procedure for removing an employee from the EPF Malaysia. EPF helps you achieve a better future by safeguarding your retirement savings and delivering excellent services. However if the employee is willing to pay contributions at 11 rate heshe should fill the Borang KWSP 17A Khas 2021.

EPF contribution rates for employers and employees as of the year 2021 Following the introduction of budget 2021 the EPF contribution rate for all employed under 60 years old is cut by default from 11 to 9 from February 2021 to January 2022. When you contribute 11 of your monthly salary to the EPF your employer will contribute another 12 or 13 of your salary the statutory contribution rate is subject to changes by the government to your EPF savings. EPF Contribution Rates for Employees and Employers.

If an employee wishes to continue contributing at the 11 rate they must complete The Borang. Employers are required to remit EPF contributions based on this schedule. In this article we have summarized the facts about EPF for both the employers and.

Every month the employer is required to submit to the government a report detailing the EPF contributions made by their employees. Employer contributes 12 of the employees salary. It is possible to delete the EPF account from the system by selecting Delete from the menu bar.

According to the scheme the EPF contribution by employer and employee are both made available. For late contribution payments employers are required to remit contributions in accordance with the third schedule as attached. For Non-Malaysians registered as members from 1 August 1998 section B of EPF Contribution Table.

The latest contribution rate for employees and employers effective July 2022 salarywage can be referred in theThird Schedule EPF Act 1991. Malaysias 9296 billion ringgit 2283 billion Employees Provident Fund Kuala Lumpur will extend reductions in employees statutory contribution rate through 2021 to. Welcome to i-Akaun Employer i-Akaun Employer USER ID.

9 of their monthly salary. Contribution rate for employees above the age of 60 remains unchanged at 0 while the minimum employers share of EPF statutory contribution rate is 4. Currently employees contribute 11 of their salary to EPF while employers must put in a minimum of 12 for salaries more than RM5000 and 13 for salaries lower than that.

As an employer you are obligated to fulfil specific responsibilities including to register your organisation and employees with the EPF ensure orderly contributions and record keeping as well as comply with the existing policies and requirements. After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age. Membership of the EPF is mandatory for.

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Eis Contribution Table 2021 For Payroll System Malaysia

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Remuneration That Subject To Employees Provident Fund Epf Socso Eis Hrdf Hills Cheryl

Employers Minimum Epf Contribution For Staff Aged 60 And Above Cut To 4 I Visit I Read I Learn

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Monthly Tax Deduction 2 Social Security Organization 3 Employee Provident Plan Skachat Besplatno I Bez Registracii

Steps To Apply Employee S Epf Contribution Rate At 11

Epf 8 Vs 11 Which Is The Best Choice For You

Payroll Panda Sdn Bhd How Do I Pay Epf

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

How Will The Reduced Epf Contribution Affect Malaysians Citizens Journal

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Kwsp Epf Employees Provident Fund Guide

Epf Change Of Contribution Table Ideal Count Solution Facebook

Epf Employer Contribution Rate Rylandcxt

20 Kwsp 7 Contribution Rate Png Kwspblogs